Lending configuration

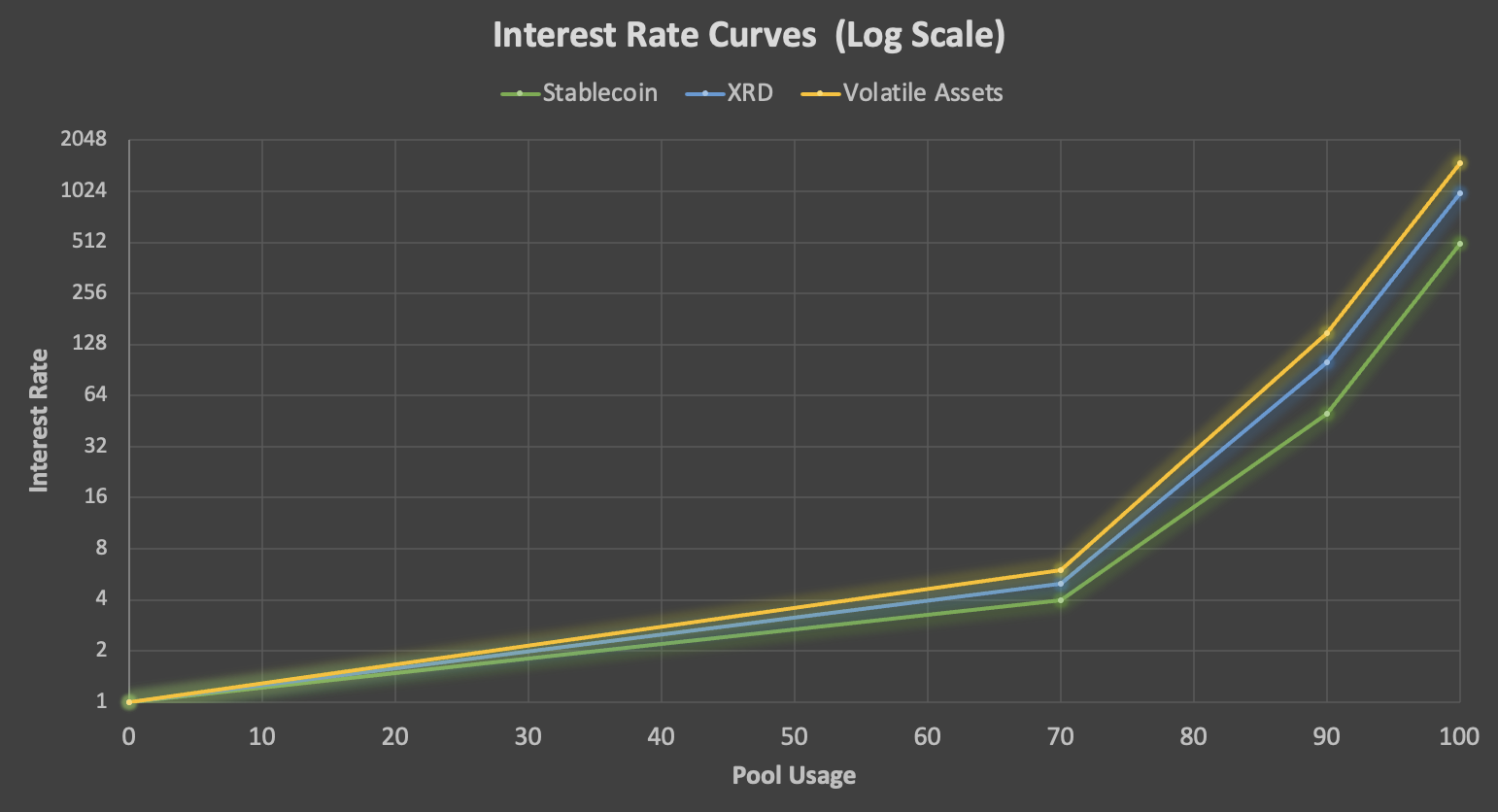

Interest rate curves

The table below details the interest rate progression for each type of asset across the three phases:

| ID | Asset Type | Normal Demand 0%-70% | High Demand 70%-90% | Max Utilization 90%-100% | Associated resources |

|---|---|---|---|---|---|

| 0 | Stablecoin | 0% to 4% | 4% to 50% | 50% to 500% | xSUDC, xUSDT |

| 1 | XRD | 0% to 5% | 5% to 100% | 100% to 1000% | XRD |

| 2 | Volatile Assets | 0% to 6% | 6% to 150% | 150% to 1500% | xwBTC,xETH |

These breakpoints ensure that interest rates reflect the varying levels of risk and demand associated with different types of assets, allowing Weft to manage liquidity effectively while optimizing returns for lenders.

Lending pools limits

| Parameter | Description | Current Value |

|---|---|---|

| FlashLoanAmountLimit | Define the maximum amount that can be borrowing a flash loan. It'as an optional parameter, but if defined, It can be in two ways: Fix amount, or a ratio of current total supply | Not defined |

| DepositLimit | Define the maximum amount of an asset that can be deposited into a lending pool. It is defined in similar ways of the FlashLoanAmountLimit | SupplyRatio: 50% |

| UtilizationLimit | Maximum allowed pool usage. Meaning the max ratio between total borrowed asset and the total deposited assets | 95% |

| InterestUpdatePeriod | Define (in seconds) the period of interest accrual update and protocol fee calculation | 86400 (1 day) |